news

EXPAT TAX

Expatriate Taxation

As an individual earning foreign income, the changes in the last budget speech have made some of us aware of complications that we are not prepared for. Expat tax as it has come to be known, is the change in foreign income exemption for South African tax residents, to include all income more than R 1 250 000 earned.

Many current South Africans living abroad believes that they are not a physical resident of South Africa, they do not have to pay heed to these taxes.

South Africa is part of the Automatic Exchange of Information (AEOI) system, a new global standard that aims to crack down on cross-border tax evasion. Which means even if you think you do not owe tax but indeed do, your foreign bank will most probably soon be exchanging your information (if indeed they are not already doing so) with SARB where SARS would come to know of any outstanding amounts due.

Is this applicable to you?

How do you confirm whether you have to pay tax?

iExpats hosts a great summary of the full considerations. We have highlighted points to look at below from the following article. https://www.iexpats.com/south-africa-expat-tax/

Is this applicable to you?

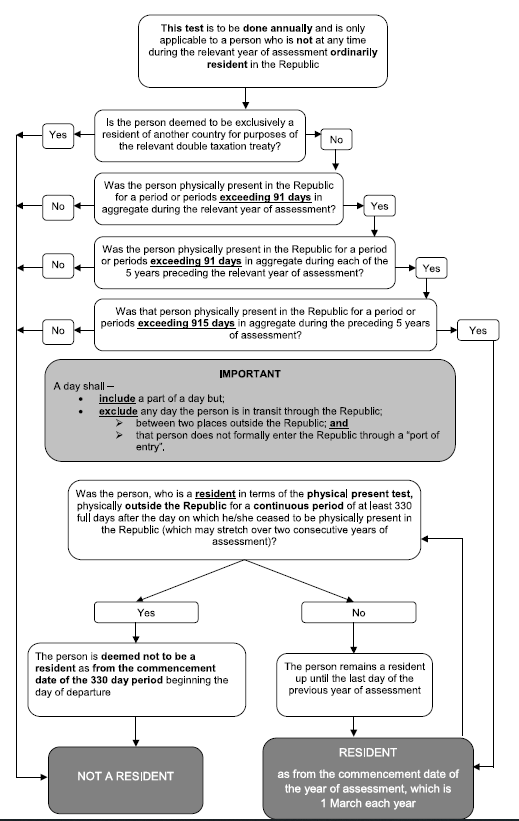

- First determine your physical presence test – See the table on pg3 and the link

- Second determine if you are a Tax resident – See link.

https://www.iexpats.com/south-africa-expat-tax/#Are_you_really_a_South_African_Expat

- If you are not any of these, take not that you have must deal with the consequences of tax immigration, if you have not done so already. Consequences of Tax immigration – See link.

https://www.iexpats.com/south-africa-expat-tax/#What_about_financial_emigration_out_of_South_Africa

It is applicable to me! How do I proceed?

If indeed you are a South African tax resident, you must now plan how to manage this tax efficiently and consider methods to reduce your tax burden in a legal way.

Zurk Botha Associates (ZBA) specializes in investments to suit your needs and to assist with your tax planning. Investments are modelled according to our risk profile and the term before you return to South Africa or require the funds.

Examples of these are:

Taxable income reduced by:

- Retirement Annuities: Contributions of up to 27.5% Taxable income may be deducted.

- Section 12J Investment: Tax deductible amounts from total taxable income. (Still liable to CGT as from R0 amount).

Tax on investments incomes and capital gains may be also be reduced:

All income including those from foreign investments forms part of your total taxable income and must be included.

- Sinking fund and endowment policies are invested in a wrapper, and not taxed in your own hands, income(growth of your investments) are then included and does not have to form part of your yearly tax calculation.

- Tax-free accounts where growth of these accounts are CGT and income tax free.

- The advantages of these products also reduce taxes and costs which may be very useful for estate/succession capital gains planning.

- All returns, interest, dividends and capital gains are not taxed in a South African Retirement Annuity.

Practical Example

You earned QAR 40 000 salary per month with QAR12 000 for housing and car allowance. As these are fringe benefits, they are also taxable which gives you an annual salary of QAR 624 000 or a R3 000 000 (aprx) income per annum. The exchange rate will be determined by the Income tax act 1962 which is an averaged exchange rate that should be used to calculate the Rand value of the foreign currency. https://www.sars.gov.za/Legal/Legal-Publications/Pages/Average-Exchange-Rates.aspx [Next publication is about:blankexpected to be posted September 2020].

| Example of No Tax efficient Vehicle | |

| Annual taxable income gross | R3,000,000.00 |

| less expat tax exclusion | R1,250,000.00 |

| R1,750,000.00 | |

| Less deductions | |

| Medical aid (Please see medical aid tax credits) (example amount) | R3,960.00 |

| Donations (maximum 10% of taxable income) | R0.00 |

| Others | R0.00 |

| Taxable income less deductions | R1,746,040.00 |

| Tax liable R532041+45% of amount over R1’500’000 | R642,759.00 |

| Individual tax rebate individuals younger than 65 | R14,958.00 |

| Tax payable Nett | R627,801.00 |

| Effective Tax rate | 20.93% |

| Example of With Tax efficient Vehicle | |

| Annual taxable income gross | R3,000,000.00 |

| less expat tax exclusion | R1,250,000.00 |

| R1,750,000.00 | |

| Less deductions | |

| Retirement Annuity (Contribution 27.5% of taxable income with maximum yearly R350 000 as example amount) | R350,000.00 |

| Medical aid (Please see medical aid tax credits) (example amount) | R3,960.00 |

| Donations (maximum 10% of taxable income) | R0.00 |

| Others | R0.00 |

| Taxable less deductions | R1,396,040.00 |

| Tax liable R207448 + 41% of amount over R708 310 | R489,417.30 |

| Individual tax rebate for individual less 65 | R14,958.00 |

| Tax amount Nett | R474,459.30 |

| Effective Tax rate | 15.82% |

| Possible yearly tax saved of | R153,341.70 |

Annexure

We are here to help you and advise you accordingly, reach out today!

Expat Tax

Zurk Botha Associates (ZBA) specializes in investments to suit your needs and to assist with your tax planning. Investments are modelled according to our risk profile and the term before you return to South Africa or require the funds.

Tel: (012) 991 3830/1

Fax: (012) 991 3991